A couple of weeks ago, Alastair Whyte, founder of Corporate Jet Investor, accused me of being infinitely optimistic. Truly I have made it a habit to find silver linings in any cloudy situation. This time, I think we may have hit upon not just silver, but in fact some gold on the horizon, by combining the unprecedented 100% bonus depreciation for pre-owned equipment in the 2017 tax reform and an interesting stimulus in recent legislation.

On March 27, the U.S. House and Senate passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in response to the COVID-19 pandemic. This legislation provides more than $2 trillion of relief to the economy to eligible businesses and individuals impacted by the novel coronavirus outbreak. We all know that, right? But beyond the PPP everyone has been discussing and the checks for Americans earning less than $75K per year, there are some other provisions that will play out over the next year.

These raise a number of questions to process as businesses across the country look to the future—especially as they consider how to address both financial concerns and those about the physical safety and mental well-being of their most important teammates. Who wants to fly commercial or require their employees to do so? And even then, the airline schedules are getting anemic.

In this blog, we will address how businesses can acquire a private aircraft—and a means to protect their greatest assets, people—at a lower net price than the actual purchase price of the aircraft.

SEC. 2203 of the CARES Act details modifications for (1) net operating losses including the temporary repeal of taxable income limitation and (2) the modification of rules relating to carrybacks. In short, this legislation loosens rules governing net operating loss deductions (NOLs), providing much-needed relief for businesses and opening doors for opportunity.

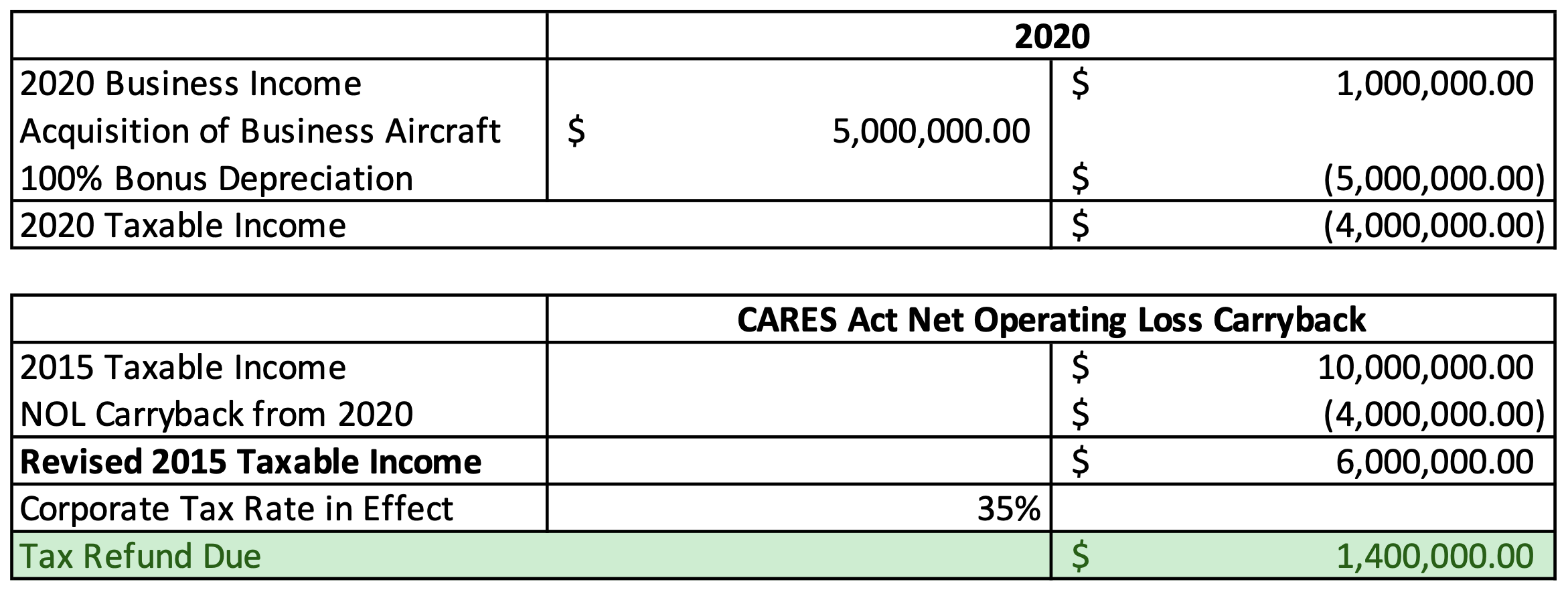

Let’s walk through this simple illustration by Daniel Cheung, CPA, who is a principal of Aviation Tax Consultants, LLC (ATC).

Your company (C corporation) has net income of $1,000,000 in 2020. You are considering the purchase of a $5,000,000 business aircraft to help manage and grow your business. Assuming 100% business use of the aircraft for 2020, you will be allowed a $5,000,000 depreciation deduction on the aircraft. The resulting tax loss is $(4,000,000). The Act allows this loss to be carried back to tax year 2015 and applied against your 2015 taxable income. This will result in a reduction of $(4,000,000) in 2015 taxable income, which is a tax refund of $1,400,000 at the federal corporate tax rate of 35%. If the loss is not fully absorbed by 2015 income, the remaining loss can be carried to 2016, 2017 tax years, etc, until fully absorbed by prior year taxable income.

There it is—the gold on the horizon. With the law going back to 2015, businesses can recapture taxes from those paid higher tax years. The same holds true for pass-through business owners (S Corporation or LLC).

Given the cascading effects of the coronavirus pandemic on the worldwide economy, we can all expect to experience some form of loss on the books in 2020. The provisions included in the CARES Act will support improved liquidity, but only if they are acted on.

By acquiring a business aircraft in 2020, taxpayers not only have the opportunity to receive tax refunds from the past five years but also a means to protect their people. There’s no better time to position your company for future success by capitalizing on the successes of the past.

Interested in learning more? Speak with one of our aviation experts today or stay up-to-date by signing up to receive our market reports.

[ulp id=’ksrvpykbSKmvluGu’]